Contents

- The Growing Trend of VC Investments: More Money, More Problems?

- When Prior Investments Cloud Judgment

- The Cost of Holding onto Underperforming Assets

- Timing Matters: Exit Late, Lose Big

- How Sunk Costs Influence Follow-On Investment Decisions

- The Psychological Cost of Not Closing Doors

- Breaking Free: How to Avoid the Inability to Close Doors Bias

- Europe vs. US: A Case Study in Strategic Discipline

- Conclusion: The Future Belongs to the Adaptable

COGNITIVE BIAS

Inability to Close Doors Bias

Published date: 20 January 2025 | 5-Min Read

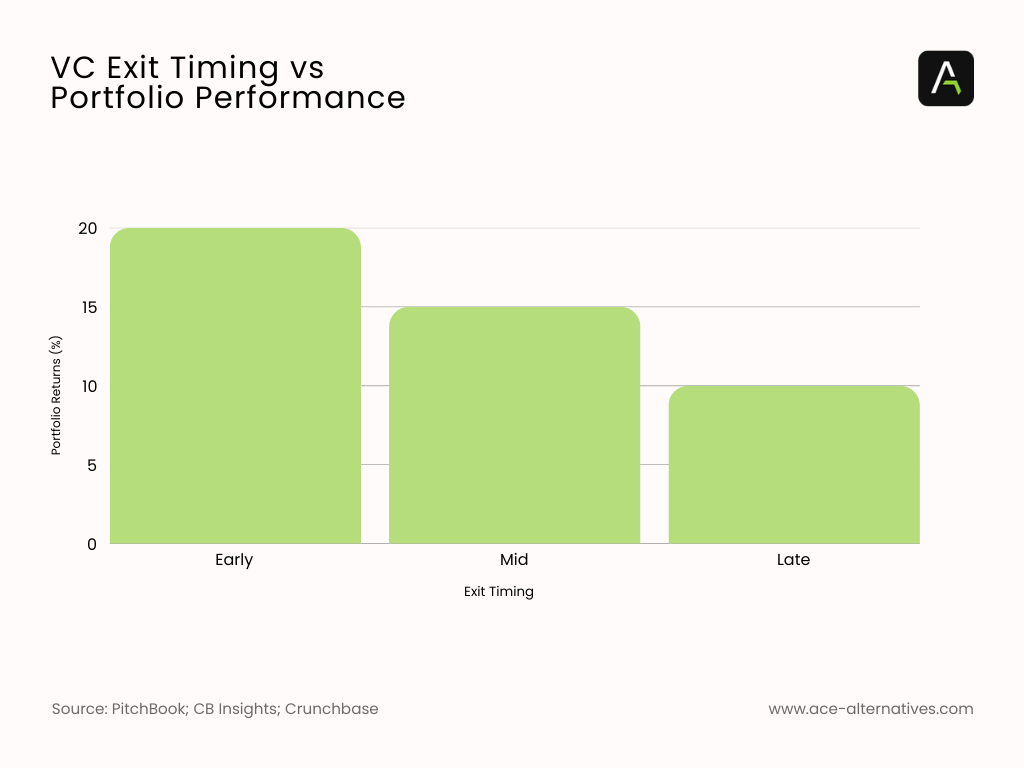

The Growing Trend of VC Investments: More Money, More Problems?

The past decade has seen a dramatic rise in VC investments across Europe.

While an influx of capital has fueled innovation, it has also led to increased risk-taking and an unwillingness to abandon failing ventures.

When funding is abundant, investors often feel less urgency to exit underperforming companies. But as markets tighten, the reality sets in overcommitting to struggling startups can drag down entire portfolios.

This is where the Inability to Close Doors Biasbecomes most dangerous.

When Prior Investments Cloud Judgment

Imagine You’re Evaluating Two Startups…

- Startup Ahas been in your portfolio for three years. It had early traction, raised significant follow-on rounds, but now struggles with scalability.

- Startup Bis a new entrant with better fundamentals, leaner operations, and a more promising trajectory.

Despite these realities, many VCs remain committed to Startup Asimply because they’ve already invested heavily. The desire to “prove the original investment right” overrides a rational assessment of future potential.

This is the essence of Inability to Close Doors Bias a reluctance to admit when an opportunity has run its course.

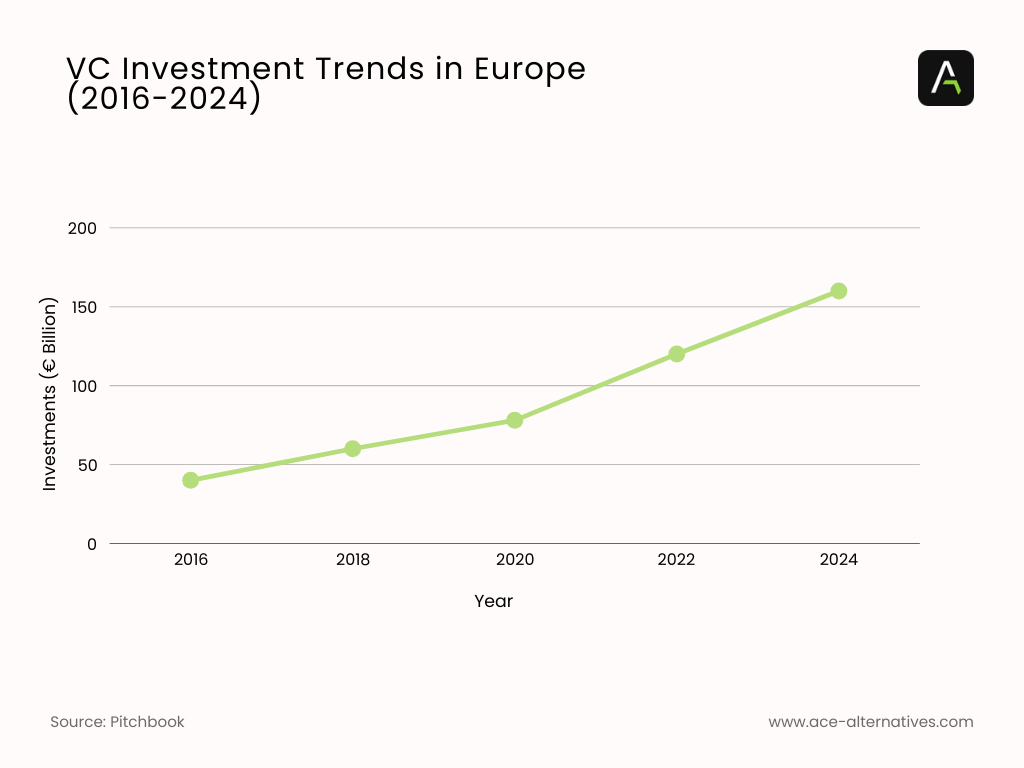

The Cost of Holding onto Underperforming Assets

The European VC market shows a surprisingly high proportion of underperforming assets across major countries.

Investors, caught in the sunk cost trap, hesitate to cut ties with startups that no longer align with their portfolio strategy.

This bias leads to:

Follow-on funding misallocations: instead of redirecting capital to high-growth opportunities, investors double down on struggling startups.

Delayed exits: hoping for a turnaround that rarely materializes.

Opportunity cost blindness: funds remain locked in low-performing ventures while better deals go untapped.

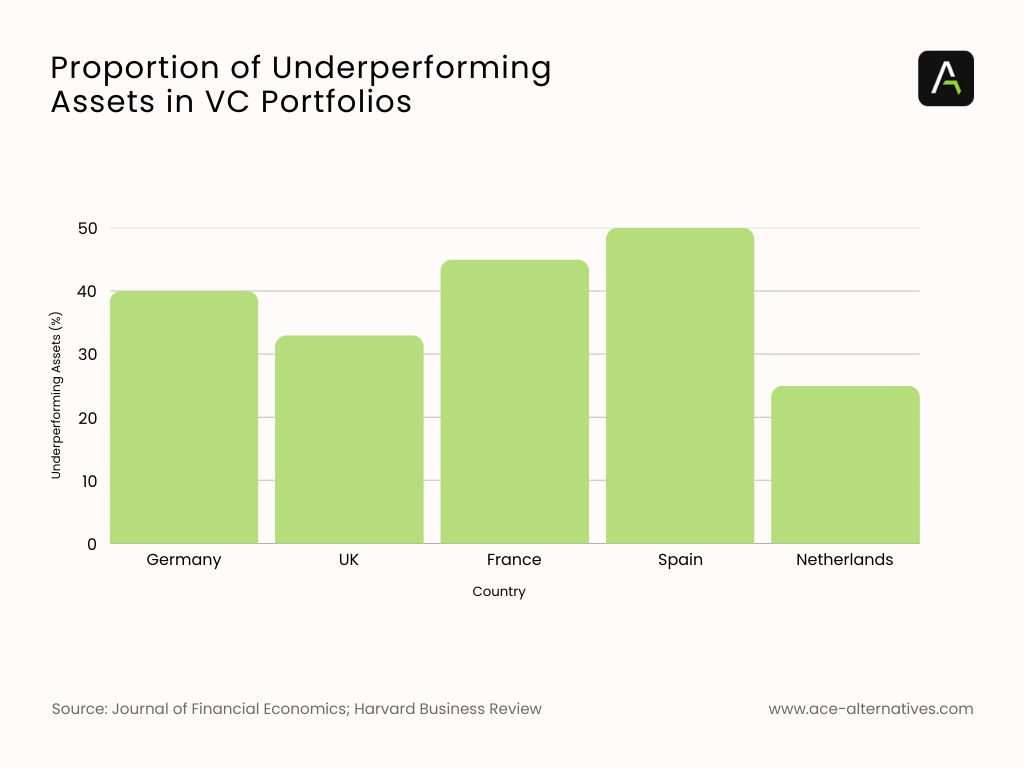

Timing Matters: Exit Late, Lose Big

Exit strategy timing is crucial to portfolio performance. Yet, VCs often delay exits, hoping for an unlikely turnaround. The data is clear: the later the exit, the lower the returns.

Why does this happen?

- Emotional attachment:Investors don’t want to admit they made a bad bet.

- Fear of reputational damage:No one wants to be the fund that pulled out “too soon.”

- Unrealistic optimism:The belief that just one more round, one more pivot, or one more market shift will turn things around.

However, the best-performing funds set clear exit triggersand act decisively when those triggers are met.

How Sunk Costs Influence Follow-On Investment Decisions

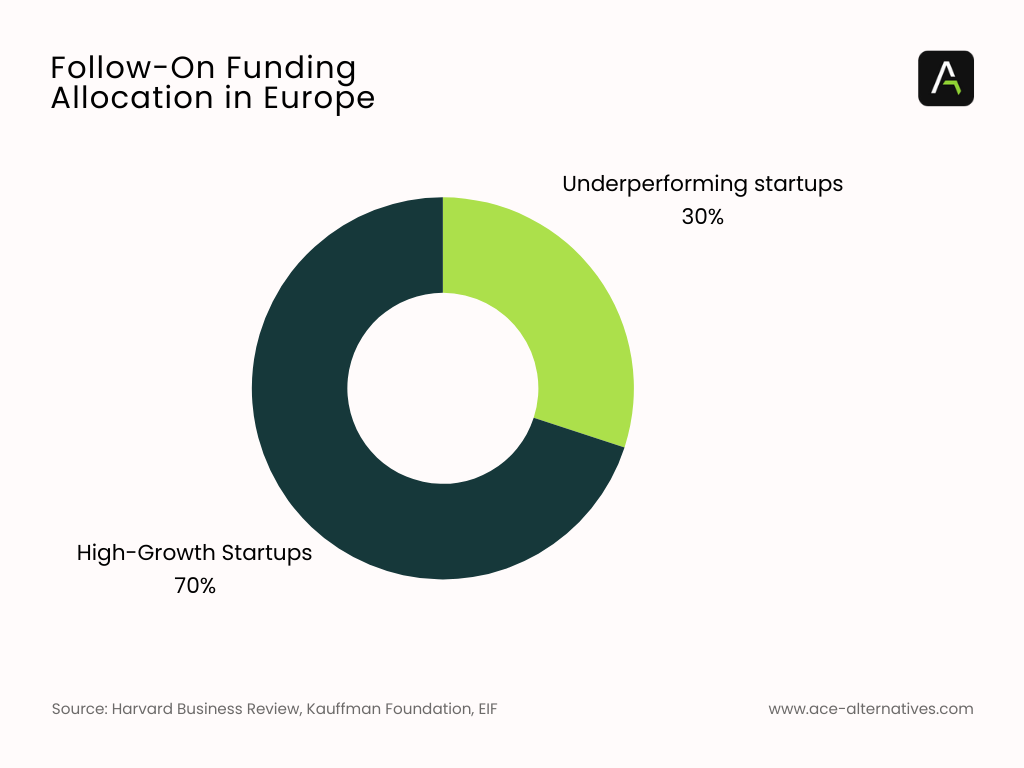

A striking 30% of follow-on funding in Europe still goes to underperforming startups.

Rather than cutting losses, many funds continue to invest in startups with dwindling prospects. This behavior, rooted in sunk cost fallacy, drains capital from higher-return opportunities.

A more rational approach? VCs should consistently evaluate follow-on investments as if they were new deals ignoring past investments and focusing only on future potential.

The Psychological Cost of Not Closing Doors

Investing isn’t just financial, it’s psychological. Letting go of an underperforming investment feels like admitting failure, which triggers loss aversion.

Common justifications for holding on too long:

“They just need more time.”

“Market conditions will shift.”

“We’re already in too deep to pull out now.”

These rationalizations fuel bad decision-making, compounding financial losses over time.

Breaking Free: How to Avoid the Inability to Close Doors Bias

- Set Clear Exit Triggers

Define performance benchmarks that automatically signal when to exit. Without predefined criteria, emotions and sunk costs take over.

- Reassess Based on Today’s Reality

Ask yourself: If this were a brand-new investment opportunity, would we invest today?

- Encourage Dissenting Opinions

Assign someone to challenge assumptions and play devil’s advocatein investment decisions.

- Prioritize Capital Efficiency Over Ego

Holding on too long not only risks capital but wastes time and opportunity. The best investors know when to cut losses and move on.

Europe vs. US: A Case Study in Strategic Discipline

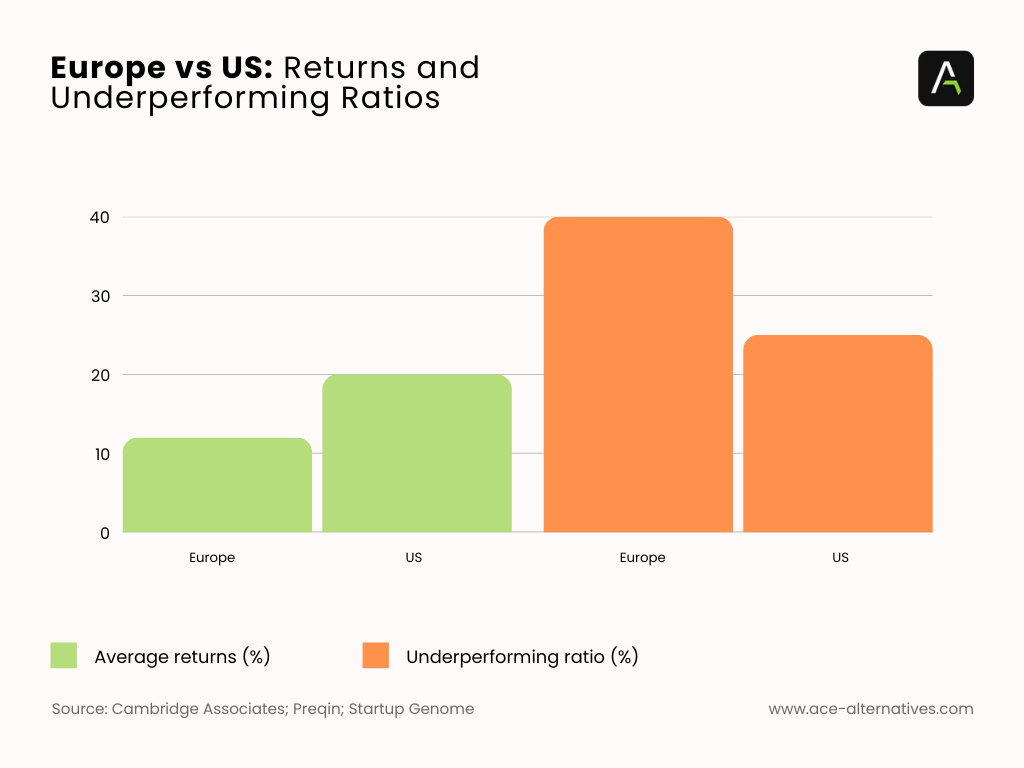

One of the most striking comparisons in venture capital is between European and US markets.

European funds have a higher proportion of underperforming assets and lower average returns compared to their US counterparts.

Why is this happening?

Stronger Exit Discipline in the US:US funds tend to cut losses faster, reallocating capital to higher-growth opportunities instead of holding onto stagnating startups.

More Aggressive Growth Strategies: European VCs often take a more conservative approach, holding onto investments longer, which may contribute to lower returns.

Cultural Differences in Risk Appetite: US investors generally adopt a fail-fast, pivot-fastermentality, while European VCs are sometimes more cautious, leading to prolonged funding of underperforming assets.

The takeaway? European VCs may need to rethink their approach to exits and capital allocation.Adopting a more US-style discipline, where underperformance is acknowledged and addressed more swiftly could lead to stronger overall returns.

Conclusion: The Future Belongs to the Adaptable

The Inability to Close Doors Bias is one of the most dangerous psychological traps in venture capital. It leads investors to overcommit, overextend, and ultimately underperform.

By recognizing and counteracting this bias, VCs can make faster, more rational decisions reallocating capital to where it will have the greatest impact.

At ACE Alternatives, we emphasize data-driven decision-making and agile capital allocation. Our tools equip investors with real-time insights to make unbiased, high-conviction choices ensuring that when a door needs to be closed, it gets closed at the right time.

Matias Collan, CEO of ACE Alternatives, emphasizes:

“Smart investing isn’t about avoiding losses altogether—it’s about knowing when to walk away.”

Sources:

Rolf Dobelli, “The Art of Thinking Clearly” (2013)

European Investment Fund (EIF)

Journal of Financial Economics

Kauffman Foundation

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.