COGNITIVE BIAS

Why the Most Obvious Choice Isn’t Always the Best

Published date: 17 February 2025 | 5-Min Read

The Availability Bias

In venture capital, investors strive to make rational, data-driven decisions. Yet, time and again, the availability bias skews judgment, leading investors to favor what is most recent, most talked about, or easiest to recall, rather than what is most relevant or fundamentally strong.

This bias causes VCs to overvalue familiar markets, underestimate unseen risks, and overinvest in overexposed trends.

The result? Capital flows toward high-visibility sectors and startups, while under-the-radar opportunities with strong fundamentals struggle.

How Availability Bias Distorts Venture Capital Allocation

The European VC market is increasingly global, complex, and fast-moving. But despite access to expansive data, many investment decisions are based on what’s most accessible and known, rather than what’s most insightful.

Availability bias plays out in several ways:

Over-investing in Trendy Sectors

Sectors like AI, fintech, and green tech dominate news cycles and investment reports. This visibility creates an illusion of low risk and inevitable returns, causing investors to over allocate fundswhile ignoring emerging but lesser-known sectors.

Relying on High-Profile Success Stories

Investors frequently recall successes but rarely analyze the thousands of startups that failed. This leads to a distorted perception of risk.

Ignoring Markets with Less Media Exposure

Venture capital tends to cluster in well-established ecosystems (London, Berlin, Paris, Stockholm), while high-potential but less-publicized regions(Lisbon, Tallinn, Eastern Europe) receive disproportionately less funding.

Availability bias doesn’t just distort what investors focus on—it narrows how they evaluate risk, opportunity, and long-term value creation.

Why Do Investors Fall for Availability Bias?

This bias happens because our brains tend to believe that whatever is easiest to remember must also be the most important or an accurate reflection of reality.

Availability bias is strongest when:

- We rely on recent, high-profile information rather than historical data or deeper research.

- We make snap judgments when unsure,using mental shortcuts rather than structured analysis.

- We overemphasize events that are sensational or widely reported, while underestimating silent but critical trends.

In venture capital, this means:

Overestimating the chances of unicorn success because success stories dominate headlines, while failures remain unseen.

Mistaking visibility for viability, assuming that widely discussed startups are also fundamentally strong.

Underestimating long-term risks because they don’t immediately come to mind.

The Real-World Impact of Availability Bias

Availability biasshapes decisions across industries, often leading to costly mistakes. In venture capital, investors may overvalue startups in trendy sectors, like AI or crypto, because they dominate headlines, while overlooking promising but less-publicized innovations. This tendency skews funding patterns, inflating valuations and creating bubbles.

If a company attributes its recent success to a visible factor like a viral marketing campaign rather than deeper, less obvious trends, it may misallocate resources, focusing on what stands out rather than what truly drives results.

Recognizing availability bias is crucial for making more rational decisions. By actively seeking broader data, questioning assumptions, and considering less obvious but relevant factors, we can reduce its impact and improve judgment.

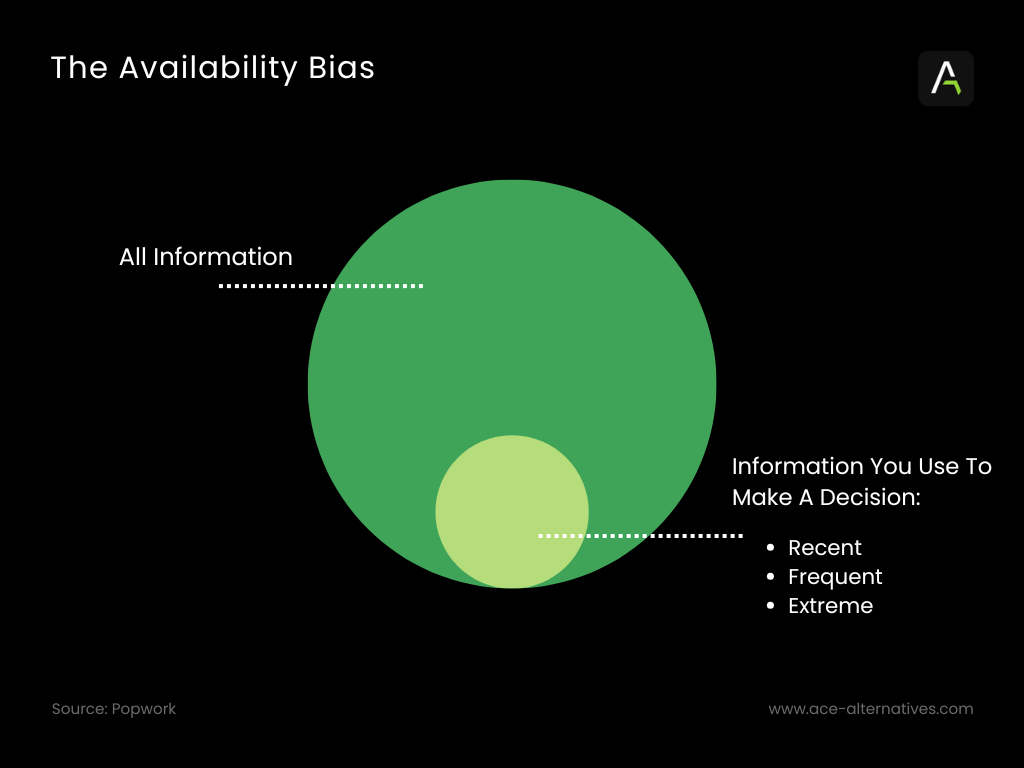

How Availability Bias Narrows Our Decision-Making

Why the Most Obvious Choice Isn’t Always the Best chart

The Availability Bias causes us to rely on a small, highly visible subset of information when making decisions, rather than considering the full picture. The image above illustrates this distortion: while all available information (represented by the larger circle) could be used for decision-making, our minds gravitate toward a much smaller subset (the smaller circle). This limited pool is typically shaped by what is recent, frequent, and extreme.

How Venture Capitalists Can Mitigate Availability Bias

1. Look Beyond the Headlines

If a sector or startup is dominating news cycles, ask yourself why? Is it truly a game-changer, or just an overhyped narrative.Broadening deal flow sources beyond mainstream coverage can help uncover overlooked opportunities.

2. Prioritize Data Over Mental Shortcuts

Instead of relying on familiar names and sectors, conduct deep, comparative analyses using historical success rates, market dynamics, and alternative data sources.

3. Expand Geographic and Sector Exposure

European venture capital remains highly concentrated in major hubs. Expanding investment focus to emerging startup ecosystems such as Lisbon, Tallinn, Warsaw, and Barcelona can reduce exposure to overinvested markets.

4. Evaluate Startups on Fundamentals, Not Visibility

A company frequently mentioned in reports or funded by high-profile investors isn’t necessarily a better investment. VCs should prioritize:

- Revenue models & unit economics

- Regulatory & market positioning

- Competitive moat & execution strategy

5. Recognize When You’re Using Availability Bias

Before making investment decisions, ask:

1. Am I considering this startup because of its true potential, or because I keep hearing about it?

2. Am I ignoring sectors or geographies simply because they’re not frequently discussed?

3. Am I making decisions based on data, or just what comes to mind first?

Recognizing when and how availability bias creeps in can significantly improve your investment decision-making.

Final Thoughts: Investing Beyond the Noise

Venture capital thrives on anticipating the future, not reacting to the present. Yet, availability bias pushes investors toward what’s already visible, loud, and overexposed.

The best investments don’t always make the headlines.

They’re in emerging markets, underestimated sectors, and data-backed opportunities that aren’t competing for attention—but are building a future with real value.

By adopting structured decision-making, diversifying investment exposure, and questioning intuitive judgments, venture capitalists can move beyond bias and toward better, long-term returns.

Sources:

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.