Guide to VC

What Is Investor Onboarding in Private Equity?

Published date: 21 March 2025 | 6-Min Read

Private equity (PE) is built on long-term relationships, strategic capital deployment, and trust. But before any capital is called or deployed, one foundational process must take place: investor onboarding.

So, what is investor onboarding in private equity & why is it such a critical part of fund operations?

In this article, we break down the PE investor onboarding process, explain how it differs from other fund types, and explore the compliance, documentation, and operational steps involved in welcoming new investors into a private equity fund.

What Is Investor Onboarding in Private Equity?

Investor onboarding refers to the process of admitting investors into a private equity fund. This includes:

- Verifying the investor’s identity and eligibility

- Collecting required documentation and disclosures

- Satisfying regulatory compliance obligations

- Establishing the investor’s participation terms in the fund

The goal is to ensure that only qualified, vetted investors enter the fund and that all legal, tax, and operational records are in place before any capital activity begins.

Why Investor Onboarding Is Critical in Private Equity

Private equity funds often have limited fundraising windows and structured commitment periods. A smooth onboarding process:

- Prevents funding delays

- Reduces legal and reputational risk

- Builds investor confidence and satisfaction

- Ensures full compliance with jurisdictional and global regulations

Unlike public market investing, PE funds deal with illiquid, long-term capital, so it’s essential to get every detail right from the start.

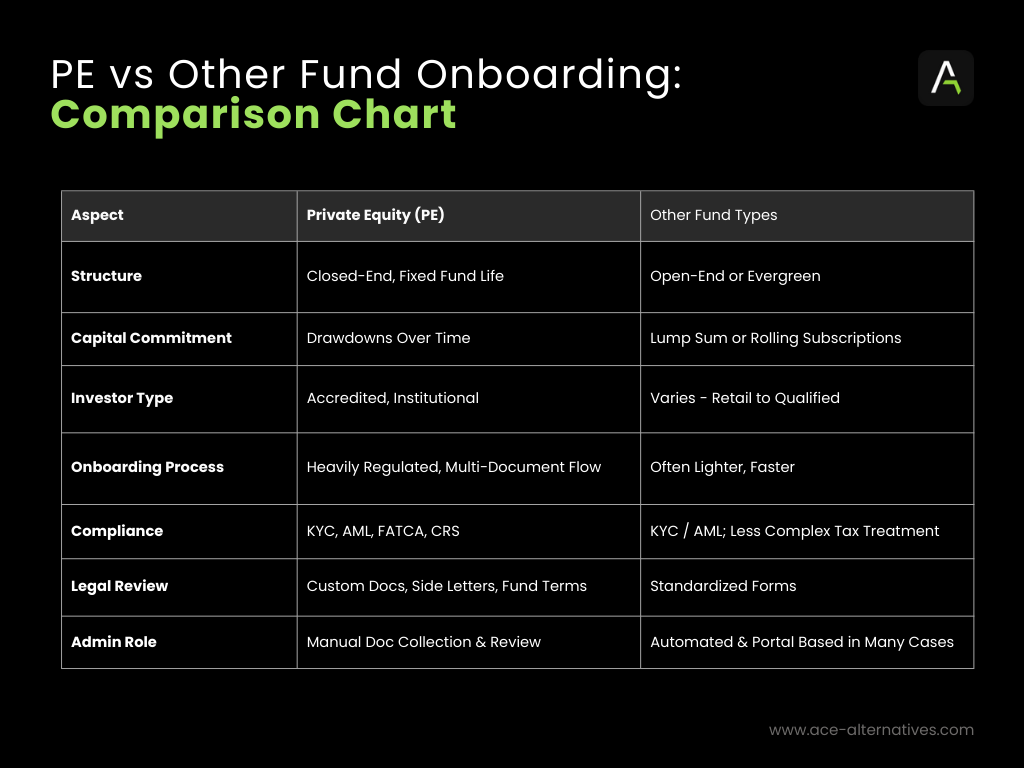

How PE Onboarding Differs From Other Fund Types

Investor onboarding in private equity differs from hedge funds, venture capital, or mutual funds in several key ways:

Structure

- Private Equity: Closed-end funds with long-term commitment periods

- Other Funds: Often open-end or evergreen, allowing rolling subscriptions or redemptions

Capital Flow

- Private Equity: Capital is drawn down over time through scheduled capital calls

- Other Funds: Investors typically invest upfront or on a continuous basis

Investor Access

- Private Equity: Typically limited to accredited or institutional investors

- Other Funds: May allow a broader range of investor types depending on the structure

Documentation

- Private Equity: Involves detailed, fund-specific legal and compliance documents

- Other Funds: Often rely on more standardized subscription processes

Key Compliance Requirements for PE Investor Onboarding

Private equity funds must meet global and jurisdiction-specific regulatory requirements, including:

- KYC (Know Your Customer): Identity verification to ensure investor legitimacy

- AML (Anti-Money Laundering): Preventing criminal funds from entering the system

- FATCA / CRS: Tax reporting compliance for US and international investors

- Accreditation Checks: Verifying investor qualification status (e.g., accredited, QIB)

Failure to comply can lead to fines, regulatory scrutiny, and even fund shutdowns.

PE vs Other Fund Onboarding Comparison Chart

Typical Documents and Steps in the Onboarding Process

A standard private equity onboarding process includes:

Subscription Agreement

Defines commitment size, investor class, and fund terms

KYC/AML Documents

Government ID, proof of address, source of funds

Investor Questionnaire

Confirms accreditation status and risk tolerance

Tax Forms (W-8/W-9, FATCA/CRS self-certifications)

Required for proper withholding and reporting

Side Letters (if applicable)

Outlines any negotiated terms for specific investors

Approval and Fund Admission

Legal and fund admin review; capital commitment confirmed

The Role of Fund Administrators and Legal Counsel

Successful onboarding requires collaboration between internal teams and third-party partners:

Fund Administrators

- Manage document collection, compliance checks, and data entry

- Interface with investors and provide investor portal access

Legal Counsel

- Drafts and reviews subscription documents, side letters, and fund terms

- Ensures regulatory compliance and fund alignment

Their coordination ensures that investors are admitted cleanly and ready to participate in capital calls and distributions.

Common Friction Points and How to Solve Them

Despite best efforts, onboarding can hit snags. Here are common issues—and how to resolve them:

Delayed document submission

- Provide a clear onboarding checklist and investor guidance

Incomplete KYC/AML information

- Use automated platforms with smart reminders

Accreditation misunderstandings

- Offer education or third-party verification support

Paper-based or manual processes

- Leverage digital investor portals and e-signature workflows

The smoother the onboarding, the better the investor experience—and the more efficient the fund launch.

Final Thoughts

Investor onboarding in private equity isn’t just an administrative task, it’s a critical process that sets the tone for the entire fund lifecycle.

By understanding the regulatory landscape, standardizing documentation, and working closely with fund administrators and legal partners, fund managers can ensure a frictionless experience that builds trust, protects compliance, and accelerates capital deployment.

Whether you’re launching your first fund or scaling an existing platform, investing in better onboarding is an investment in long-term success.

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.