Guide to VC

What Is Fund Tax? A Beginner’s Guide

Published date: 17 March 2025 | 5-Min Read

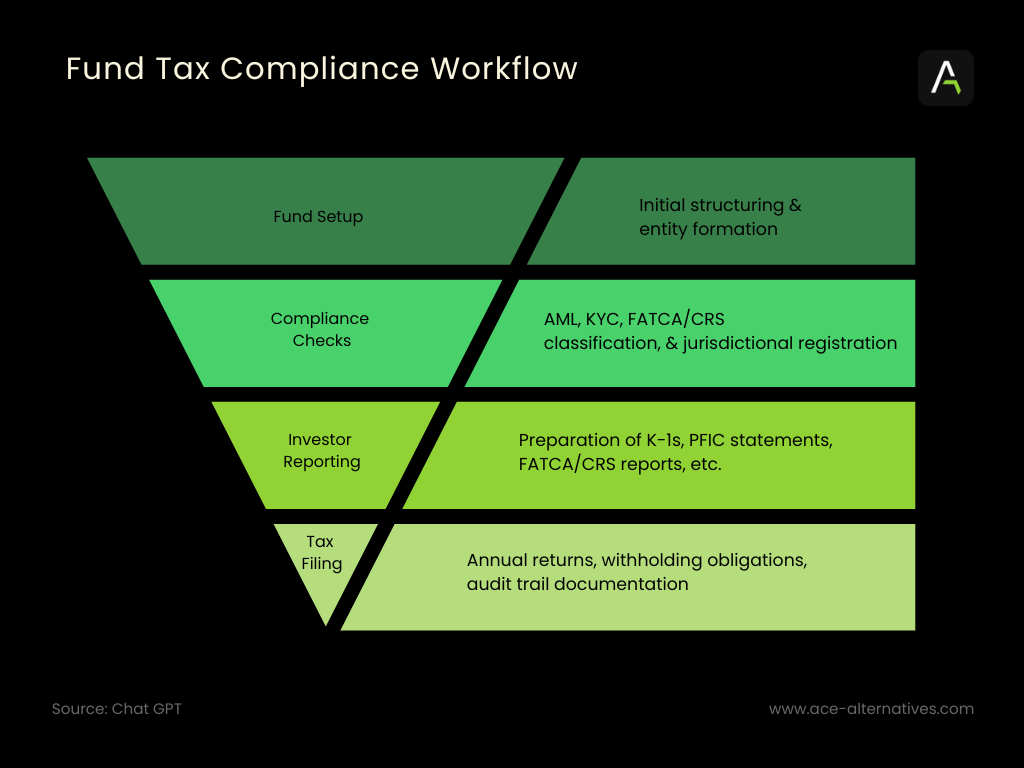

In the world of alternative investments, taxation is one of the most complex and critical areas fund managers must navigate. From ensuring compliance with ever-evolving international regulations to structuring funds to be tax-efficient for investors, fund tax plays a central role in both fund operations and investor satisfaction.

What Is Fund Tax?

Fund tax refers to the set of rules, obligations, and processes that govern how investment funds and their investors are taxed. This includes fund-level taxes, investor-level tax reporting, cross-border compliance obligations, and the preparation of tax-related documentation.

Unlike corporations, most investment funds are structured as flow-through vehicles, meaning income, gains, losses, and deductions pass through to investors. But that doesn’t mean funds are free from tax complexity; in fact, the opposite is true.

Key Tax Considerations for Funds

Fund taxation is multi-layered, and the complexity increases depending on the structure, domicile, investor base, and investment strategy. Here are some of the major areas fund managers need to stay on top of:

- Fund Structure and Tax Treatment

How a fund is structured (e.g., LP, LLC, trust, corporate entity) has a direct impact on its tax obligations. For example:

- Flow-through entities (LPs, LLCs) typically don’t pay income tax at the fund level.

- Blocker corporations are often used to shield certain investors (like non-US investors) from direct US tax exposure.

- Investor Tax Reporting

Funds must issue tax documents to investors, such as:

- K-1s (for US partnerships)

- PFIC statements (for offshore entities)

- CRS and FATCA reports (for global tax transparency)

These reports must be accurate, timely, and jurisdiction-specific, especially when investors are located across multiple countries.

- Withholding & Global Compliance

Funds may be required to withhold taxes on behalf of investors, depending on jurisdiction. For example:

- FATCA (Foreign Account Tax Compliance Act) requires US funds to report information on foreign investors.

- CRS (Common Reporting Standard) extends similar obligations globally.

Failure to comply can result in penalties, investor dissatisfaction, and reputational damage.

- Tax Filing and Reporting Requirements

Funds must also comply with local and international tax filing requirements, including:

- Annual fund tax returns

- Withholding tax filings

- Jurisdictional registrations

- Compliance certificates (e.g., UK Reporting Fund Status)

These filings often require coordination between fund administrators, tax advisors, and legal teams.

The Role of Fund Administrators in Tax Support

At Ace Alternatives, tax services are integrated with fund administration to ensure seamless data flow, accuracy, and compliance. Here’s what an experienced fund administrator typically handles:

- Gathering and validating tax-relevant data

- Coordinating with legal and compliance teams

- Preparing and distributing tax documentation

- Managing withholding and investor-specific rules

- Supporting audits and jurisdictional inquiries

This collaborative approach helps minimize the burden on fund managers and ensures investors receive high-quality, compliant reporting.

Common Fund Tax Mistakes to Avoid

Fund managers must avoid the following pitfalls to protect both their funds and investors:

- Late or inaccurate K-1 delivery

- Improper FATCA or CRS classification

- Failure to obtain reporting fund status

- Ignoring local tax registration deadlines

- Inconsistent tax and financial reporting

By working with experienced administrators and tax professionals, many of these risks can be eliminated.

FAQs

What is fund tax in private funds?

Fund tax refers to the compliance and reporting obligations related to how fund income and gains are taxed at both the fund and investor levels.

Are funds taxed like corporations?

Most funds are structured as flow-through entities, meaning taxes are paid by investors, not at the fund level—though some exceptions apply.

Who handles fund tax reporting?

Fund administrators work closely with tax advisors and legal teams to manage filings, issue investor documents, and ensure jurisdictional compliance.

Final Thoughts: Build a Tax-Ready Fund from Day One

Tax is no longer a once-a-year headache—it’s a daily operational consideration for modern funds. From structuring and compliance to investor communication, fund tax is a critical area that deserves proactive, professional management.

At Ace Alternatives, we help fund managers implement a future-proof tax and reporting infrastructure, tailored to your fund’s strategy, jurisdiction, and investor base.

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.