COGNITIVE BIAS

Clustering Illusion Bias

Published date: 17 March 2025 | 5-Min Read

The Psychology Behind the Clustering Illusion in Investing

Recognizing trends and patterns is essential, but sometimes, the patterns we see are actually illusions. The Clustering Illusion Bias leads investors to perceive patterns in random data, believing that short-term trends indicate larger, meaningful shifts.

The human brain is wired to seek order in chaos. As such, investors instinctively look for signals amid market fluctuations, interpreting small clusters of data as evidence of a broader trend. This cognitive shortcut, while useful in some areas of life like spotting patterns in weather or human behavior, it can become misleading in complex, probabilistic environments like financial markets.

At its core, the clustering illusion stems from our discomfort with randomness. Humans are natural pattern-recognizers; we evolved to identify associations quickly, often as a matter of survival. But in markets, where randomness plays a large role, this instinct can backfire.

When a handful of tech stocks rally over a few days, or when several IPOs launch in a single quarter, the brain leaps to conclusions: “This sector is hot,” or “Momentum is building.” Such events may be entirely coincidental or statistically insignificant.

This illusion is reinforced by Availability Bias and the It’ll-Get-Worse-Before-It-Gets-Better Fallacy. Once we notice a pattern, we look for more evidence to support it and give extra weight to the most recent examples. We may overlook broader data that contradicts the trend, or we might ignore the role of chance altogether. As a result, investors may double down on positions based on streaks that are nothing more than noise.

Understanding the psychology behind the clustering illusion is crucial for making more rational investment decisions. Recognizing when your mind is searching for patterns that aren’t really there can help prevent premature conclusions, overtrading, and misallocation of capital.

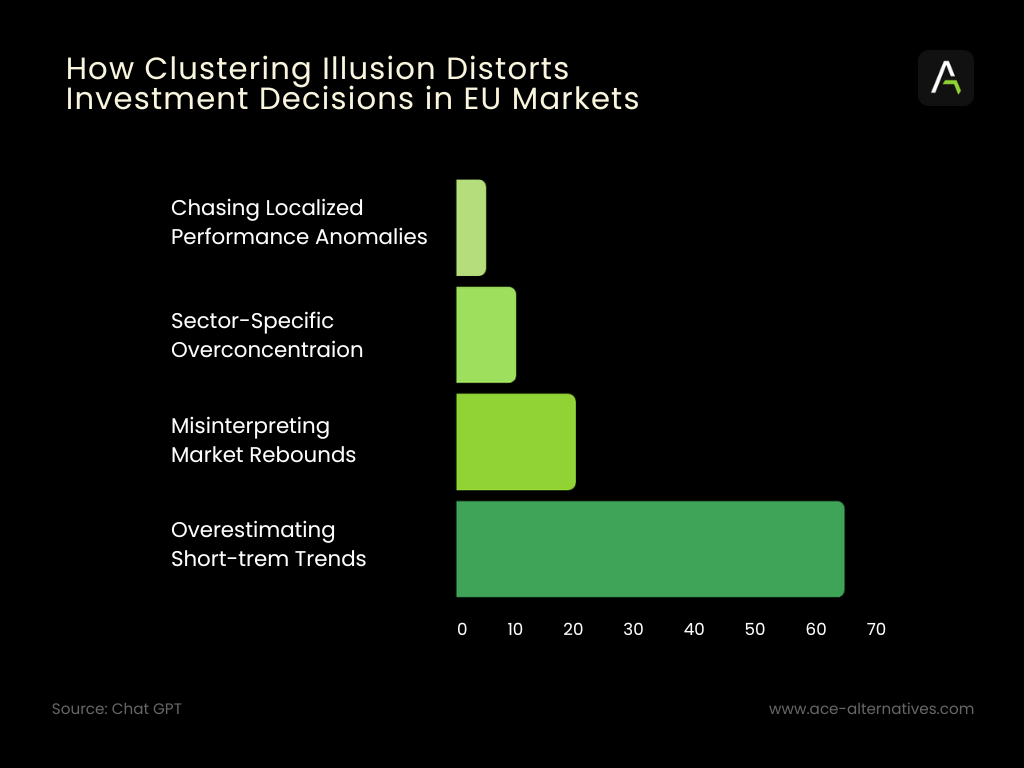

How Clustering Illusion Distorts Investment Decisions in EU Markets

The European financial ecosystem is complex, with diverse economies, regulatory frameworks, and market structures. Clustering Illusion can mislead investors in several ways:

How Clustering Illusion Distorts Investment Decisions in EU Markets

1. Misreading Local Hotspots as Continental Momentum (5%)

A string of standout IPOs or high-profile exits in a single country, such as France or Germany, can lead investors to assume a pan-European growth wave. In reality, these outcomes are often driven by hyper-localized policies, like tax relief for innovation or region-specific venture support—not by macroeconomic strength across the EU.

2. Momentum-Driven Overload in Niche Sectors (10%)

Short bursts of activity in sectors like fintech or biotech can create the illusion of lasting opportunity. Investors, influenced by clustering patterns, may flood into these industries just as the momentum begins to fade, unaware that the rally may be the result of short-term enthusiasm rather than a sustainable trend.

3. Confusing Temporary Bounces with Structural Shifts (20%)

Economic troughs in Europe are sometimes followed by quick recoveries, which can be misinterpreted as signs of enduring transformation. This illusion can cause overinvestment in recovering markets, where the fundamentals have not yet caught up to investor expectations.

4. Misjudging the Depth of Emerging Trends (65%)

Several months of strong performance in areas like renewable energy can appear to validate a major thematic shift. But these gains might be tied to transient factors—such as regulatory announcements, temporary subsidies, or speculative inflows—not to a durable long-term growth story.

Examples of the Clustering Illusion in EU Markets

1. “Hot Stock” Streaks in the DAX (Germany)

Investors scanning the DAX 40 index often spot what looks like a pattern: a handful of tech or automotive stocks outperforming over a short time span. This perceived cluster is frequently interpreted as a sign of momentum or insider activity, leading to a rush of buying in the sector.

In reality, short-term outperformance across a few companies is often due to random variation. The clustering illusion can cause investors to assign meaning where none exists.

2. EuroMillions and National Lottery Strategies

In games of pure chance like EuroMillions.com or the UK National Lottery, many players believe certain number sequences appear in “clusters” more than others. As a result, they may avoid recently drawn numbers, thinking they’re “cold,” or repeatedly play numbers that just appeared, assuming they’re “hot.”

This is a textbook example of the clustering illusion: each draw is statistically independent, yet our brains look for streaks and trends. While the financial stakes here may seem low, this bias highlights how people can misread randomness even when the probabilities are clearly defined, something that also shows up in investing behavior.

3. Housing Market Misreads: Berlin

In Berlin, a spike in property prices within a few central neighborhoods was interpreted by many investors as a sign of a city-wide boom. Real estate funds and private investors poured in, expecting sustained appreciation.

However, the original cluster of rising prices was driven by a few atypical transactions, such as redevelopment sales or premium purchases that skewed local averages. The clustering illusion made the anomaly appear like a trend, drawing in capital that later faced stagnating or falling prices as the broader market failed to follow suit.

4. Nordic Startups

Countries like Sweden and Estonia have produced global success stories like Spotify, Klarna, and Skype. This concentration of “wins” has led many investors and media outlets to view the region as a hotspot for unicorns, assuming a consistent pipeline of high-return ventures. But this belief often rests on a small number of standout cases, clustered together in time.

The clustering illusion here inflates expectations and can distort valuations, particularly for early-stage startups that haven’t yet demonstrated traction or revenue. It’s a classic case of mistaking a few outliers for a trend.

Strategies to Mitigate the Clustering Illusion Bias

Recognizing and counteracting the Clustering Illusion can help investors make more rational decisions. Here’s how:

1. Zoom Out: Look at Long-Term Performance

Instead of focusing on short-term movements, analyze market trends over extended periods. A six-month rally in EU tech stocks might seem significant, but how does it compare to historical performance over the past five to ten years?

2. Use Statistical and Quantitative Analysis

Leverage data-driven tools to determine whether an observed pattern is statistically significant or just noise. Use rolling averages, mean reversion analysis, and volatility assessments to validate trends.

3. Diversify Across Sectors and Regions

Avoid concentrating investments in one sector or country based on recent momentum. A well-diversified portfolio helps mitigate the risks of overcommitting to patterns that may be random fluctuations.

4. Challenge the Narrative with Contrarian Thinking

When market sentiment overwhelmingly supports a supposed trend, ask: What if this is an illusion? Testing prevailing assumptions can help investors avoid herd mentality and make independent, evidence-based decisions.

Final Thoughts: Investing Beyond Random Patterns

The Clustering Illusion reminds us that not all observed market trends are real. While patterns in EU markets may appear compelling, they often result from randomness rather than fundamental shifts.

By maintaining a long-term perspective, using rigorous data analysis, and diversifying investments, investors can avoid the pitfalls of seeing patterns where none exist.

Successful investing in Europe—or anywhere—requires discipline, skepticism, and a commitment to sound fundamentals over fleeting market noise.

Sources:

Rolf Dobelli, “The Art of Thinking Clearly” (2013)

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.