Guide to VC

Infrastructure Accounting for Private Funds Explained

Published date: 21 March 2025 | 5-Min Read

Infrastructure accounting for private funds plays a critical role, offering stable returns, inflation protection, and long-term growth potential. From toll roads and airports to renewable energy and digital infrastructure, these projects require not just large capital outlays, but also specialized accounting frameworks that reflect their unique nature.

What Is Infrastructure Accounting?

Infrastructure accounting for private funds refers to the financial tracking, valuation, and reporting practices used by private funds that invest in long-term, income-generating assets like energy, utilities, transport, and communications.

Unlike typical PE or VC investments, infrastructure assets have:

- Extended investment horizons (10–30+ years)

- Predictable cash flows

- Stable but regulated revenue models

- High upfront capital costs with gradual returns over time

Fund accountants must structure reporting and valuations to reflect the lifecycle of these assets, from greenfield development to brownfield operation and eventual exit or recapitalization.

Revenue Recognition and Lifecycle-Based Accounting

Infrastructure assets go through distinct phases, each with its own accounting considerations. Here’s how revenue recognition aligns with the asset lifecycle:

Development Phase

- Capitalized costs such as design, permitting, and early-stage planning

- Revenue not typically recognized until operations begin

- Delays and overruns must be tracked as they impact future projections

Construction Phase

- Work-in-progress (WIP) accounting is used to track capital expenditures

- Costs are accumulated on the balance sheet until the project becomes operational

- Potential for milestone-based recognition if tied to performance obligations

Operational Phase

- Revenue is recognized regularly based on usage (e.g., tolls, tariffs, contracts)

- Must factor in performance-based adjustments, availability penalties, and O&M reserves

- Consistent cash flow tracking is essential for fund reporting and IRR modeling

Exit or Refinance Phase

- Gains are realized through asset sales, refinancing, or recapitalization

- Reclassification of assets may be required on the balance sheet

- Final income recognition aligns with liquidity events and investor distributions

Risk Modeling and Performance Tracking

Accounting for infrastructure requires constant monitoring of project-specific risks:

- Construction risk: Delays, budget overruns

- Operational risk: Downtime, regulatory changes

- Credit risk: Counterparty default

- Market risk: Interest rate shifts, inflation indexing

Fund accountants play a key role in tracking actual vs projected cash flows, flagging underperformance, and adjusting models based on real-world inputs. Performance metrics like IRR, net cash yield, and debt service coverage ratio (DSCR) are commonly tracked.

Valuation: DCF and IRR Take Center Stage

Because infrastructure assets are often privately held and not frequently traded, fair value is typically derived from discounted cash flow (DCF) models.

Key inputs for valuation include:

- Projected net operating income (NOI)

- Remaining contract life or concession period

- Discount rate reflective of risk and market conditions

- Residual or terminal value assumptions

Fund managers also rely on internal rate of return (IRR) benchmarks to assess performance over time and guide carry calculations.

Managing Fund Cash Flows and Capital Structure

Infrastructure funds tend to have complex capital structures, including:

- Senior and subordinated debt layers

- Construction loans and bridge financing

- Long-dated equity capital with recycling mechanisms

Fund accountants must:

- Track capital deployment in tranches

- Allocate interest, fees, and repayments accurately

- Model future cash flows for distribution waterfalls

- Monitor leverage ratios and covenant compliance

Since cash flow timing is paramount in infrastructure, accounting teams serve as strategic partners in liquidity planning and investor communication.

Reporting and Regulatory Requirements

Infrastructure fund managers are held to high standards for transparency and compliance. Fund accountants must prepare:

- Quarterly investor reports with cash flow projections, IRRs, NAV, and updates on each asset

- Capital account statements tailored for long-horizon LPs (like pensions and insurers)

- Regulatory filings under GAAP or IFRS, often incorporating IFRIC 12 (for service concession arrangements)

- Support for third-party valuations and audits involving infrastructure-specific assumptions

Proper documentation, especially of inputs and model logic, is critical to ensure auditability and LP trust.

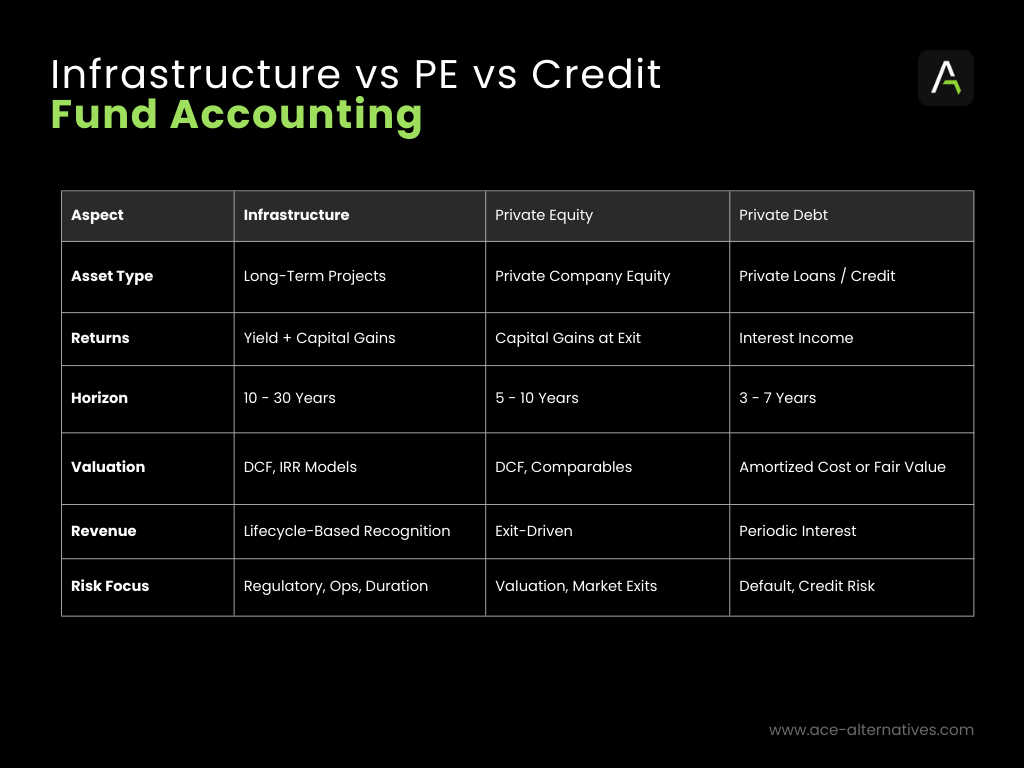

Infrastructure vs PE vs Credit Fund Accounting

Final Thoughts

Infrastructure accounting for private funds is where finance meets engineering, law, and economics. With multi-decade timelines, layered financing, and tightly regulated revenue models, infrastructure funds require specialized accounting teams and robust systems to deliver accurate valuations, manage risks, and meet investor expectations.

As infrastructure continues to attract institutional capital, fund managers who embrace sophisticated, lifecycle-based accounting practices will be best positioned to scale their platforms and deliver on the promise of long-term, stable returns.

About ACE Alternatives

ACE Alternatives (“ACE”) is a tech-driven service provider for Investment Fund Manages in the Alternative Assets space. ACE’s vision is to redefine fund management by demystifying complexities and promoting transparency.

Asset classes include Venture Capital, Private Equity, Private Debt, Fund of Funds, Real Estate, and more. With a proprietary tech platform and extensive industry experience of the team, ACE offers 360 degree tailored solutions for fund administration, tax and accounting, compliance and regulatory, ESG needs. The fintech was founded in Berlin in 2021 and has since established itself as one of the fastest growing alternative investment fund service providers in Europe. ACE is currently working with over 45 funds and steadily growing its customer base.